The Ultimate Guide to Understanding SSS Contributions

In today's complex world of finances and social security, understanding SSS contributions is crucial for every working individual. Whether you are an employee, an employer, or an overseas Filipino worker, grasping the ins and outs of SSS contributions can significantly impact your future financial stability. From calculating your contributions accurately to exploring the various benefits that come with regular SSS contributions, this guide aims to simplify the often daunting realm of social security.

Navigating the realm of SSS contributions involves more than just fulfilling a mandatory requirement – it presents an opportunity to secure your financial well-being and that of your loved ones. By delving into the essentials of SSS contributions, you can stay informed about important updates, payment methods, and the fundamental aspects that shape this integral component of social security in the Philippines. Let's embark on this journey together to gain a comprehensive understanding of SSS contributions and empower ourselves to make informed decisions for a more secure financial future.

How to Calculate SSS Contributions

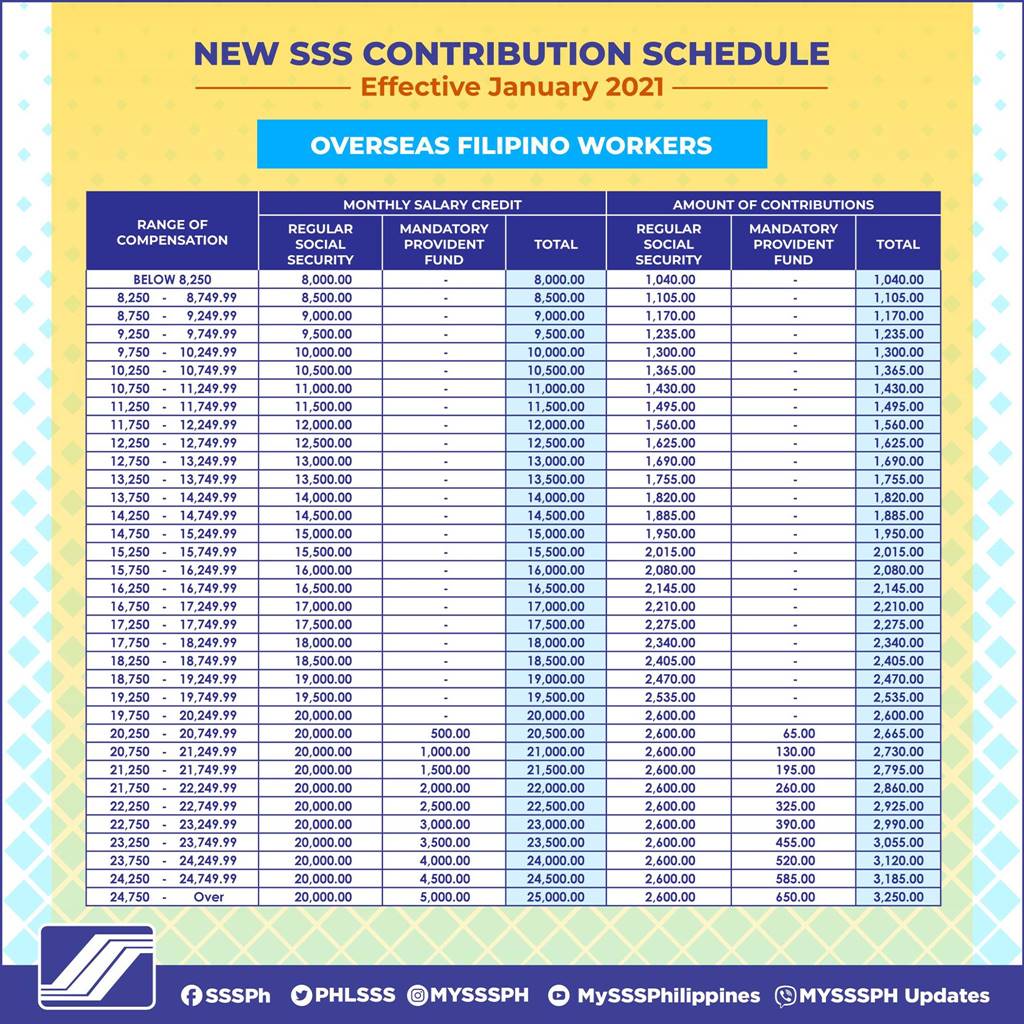

Calculating your SSS contributions involves looking at your monthly salary credit, which determines the amount you need to contribute. SSS Contributions Payment Methods from a minimum to a maximum amount set by the Social Security System. To get an idea of how much you should contribute, the SSS provides a contribution table that you can refer to.

To compute your SSS contribution, you can use the prescribed formula based on your monthly salary credit. Essentially, you will multiply your monthly salary credit by the contribution rate set by the SSS. This calculation determines the total amount that you need to deduct from your salary for your SSS contribution. It's important to keep track of any changes in the contribution rate to ensure your contributions are up to date.

For employed individuals, the employer also provides a portion of the SSS contribution on behalf of the employee. By understanding how to calculate SSS contributions, you can ensure that you are meeting your obligations and securing your future benefits under the Social Security System.

Benefits of Regular SSS Contributions

Regular SSS contributions offer financial security and peace of mind in times of need. By consistently contributing to SSS Contributions Explained , you are ensuring that you have access to various benefits such as sickness, maternity, disability, retirement, and death benefits.

Moreover, maintaining regular SSS contributions can also lead to higher benefit amounts in the future. The more you contribute, the greater the benefits you will be eligible to receive when the time comes for you to claim your SSS benefits.

In addition, being diligent with your SSS contributions can help you build a solid financial foundation for yourself and your family. It serves as a form of savings that you can rely on during emergencies or when you reach retirement age. Overall, regular contributions to SSS contribute to your financial well-being and provide a safety net for the future.

Latest Updates on SSS Contributions

Recently, the Social Security System (SSS) announced a new online portal for convenient and secure payment of contributions. With this update, members can easily track their payment history, view their current contribution status, and make payments online without the need to visit a physical SSS branch.

Furthermore, the SSS also introduced a simplified contribution schedule based on the member's monthly salary credit. This update aims to make it easier for both employees and employers to calculate and allocate the correct amount of SSS contributions, ensuring compliance with the latest contribution regulations.

For Overseas Filipino Workers (OFWs), the SSS implemented a more accessible way to remit their contributions through accredited partner banks and payment centers abroad. This improvement enables OFWs to fulfill their SSS obligations conveniently from their country of work, ensuring they can enjoy the benefits of regular contributions even while overseas.